Perhaps the most pressing question facing the golf industry over the past several years is whether the “pandemic dividend” would last.

There were further encouraging signs in 2023, with increases in participation and play, a healthier balance between the number of golfers and courses, and an evolution of a traditional game that’s positively affecting golf demand… and golf’s brand.

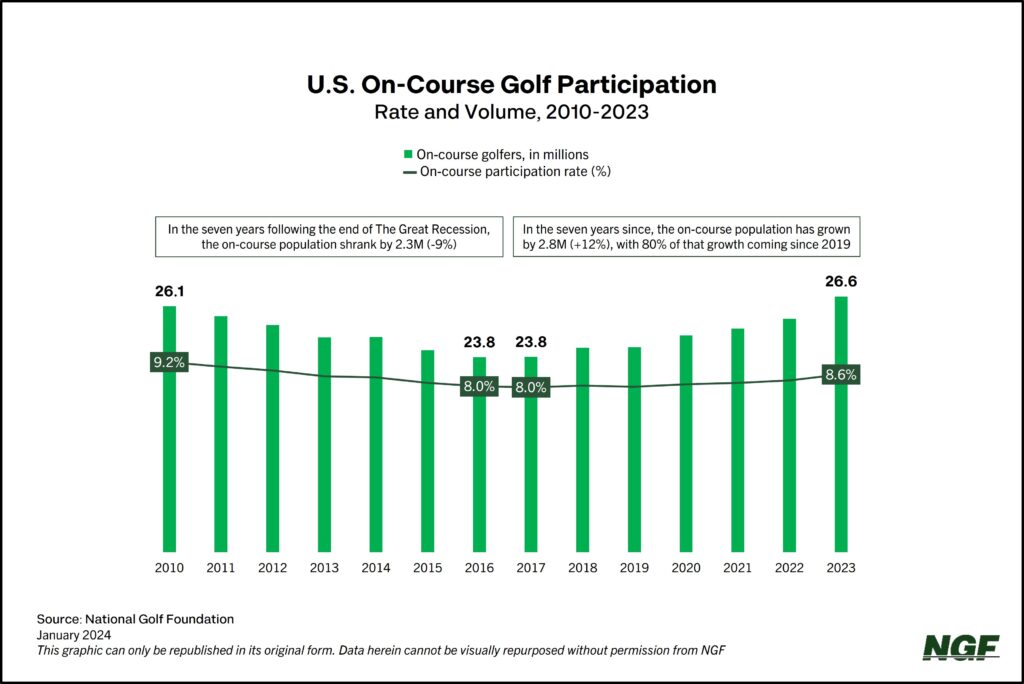

An estimated 26.6 million Americans played golf on a course in 2023, a net increase of approximately one million golfers. It’s the biggest single-year jump in on-course participants since 2001, the year Tiger Woods held all four major titles simultaneously – aka “The Tiger Slam” — which helped spur recreational golf engagement levels to new heights.

In the “Covid era,” the game has experienced momentum not seen since that “Tiger Boom,” with record or near-record levels of play and high-water marks for beginners and interest among non-golfers. The number of rounds of golf played in 2023 will check in just shy of the all-time high (in 2021) when the December data is released at the end of this month.

It’s not just a post-pandemic carryover either. The popularity and increasing availability of off-course forms of golf are introducing more people to the game in different ways, helping not only increase interest in golf but driving record on-course trials and creating a consumer base that’s more diverse than ever. Total participation – counting both green-grass and off-course play (like that at Topgolf or in indoor simulators) – climbed to 45 million in 2023, a 9% year-over-year gain and a jump of over 50% in the past decade.

When looking at the nearly 14,000 golf facilities nationwide, rounds per course over the past few years are at their highest levels since the early 1990’s, an indication of the better balance between supply and demand.

Golf course closures in 2023 dipped to their lowest levels since prior to the Great Recession. And there were more new course openings last year than any time since 2010.

NGF’s full state-of-industry – the annual member-only Graffis Report – will include comprehensive information on participation, engagement, supply and much more upon its release next week ahead of the PGA Merchandise Show. A detailed one-page “leaderboard” on the industry’s key metrics is being shared today with our Executive Members.

While many of golf’s traditional KPIs are resoundingly positive, this doesn’t mean all golf businesses are thriving.

The above is primarily related to golf facilities and course operators. Many businesses in and around the golf industry are feeling the pinch of cautious consumerism. We will not only expound more on the above topics – most notably participation segments, supply trends and rounds – in Fortnight over the coming weeks and months, we’ll also be delving into golfer sentiment and behaviors.

So, stay tuned, and be sure to get your copy of the latest Graffis Report, which is named after our NGF founders.

If you’re not yet a member, what are you waiting for? With everything that’s happening in an evolving industry, 2024 is the year to join hundreds of other businesses, facilities, organizations, and individuals in the NGF member community.